The Global Anti-Base Erosion (GloBE) Rules are a set of internationally agreed-upon tax rules developed by the Organisation for Economic Co-operation and Development (OECD) to address profit shifting and base erosion by multinational enterprises (MNEs). These rules are part of the OECD's Base Erosion and Profit Shifting (BEPS) initiative, specifically under BEPS Action 15, known as the "Two-Pillar Solution to Address the Tax Challenges Arising from the Digitalisation of the Economy."

By Utkarsh Trivedi – Partner | Deloitte India and Manish Shah – Subject Matter Expert

Table of Contents

- Journey of the Rules and Other Related Developments

- Overview of the Rules

- India Impact

- Practical Issues

- Way Forward and Futuristic Outlook

1. Journey of the Rules and Other Related Developments

1.1 OECD Pillar Two – Roadmap to Implementation

October 2020

Pillar One and Pillar Two Blueprints

June/July 2021

- G7 Finance Ministers meeting

- Inclusive Framework meeting

- G20 Finance Ministers meeting

October 2021

Inclusive Framework meeting G20 Finance Ministers meeting

- Implementation plan

- Remaining political issues

On 8th October over 135 countries representing more than 95% of global GDP joined the two-pillar solution

December 2021

Release of OECD Pillar Two Model GloBE Rules

February to June 2022

Pillar One – Amount A public consultation documents released pertaining to several of the building blocks

March 2022

Pillar Two Model GLoBE Rules commentary

December 2022

- Public consultation document titled “Pillar One – Amount B”, Pilar Two – Tax certainty and GLoBE Information Return

- Release of Transitional Safe Harbour Rules

2023

3 Agreed Administrative guidance on GLoBE Rules

2024

Implementation of IIR and QDMTT law in 28+ countries for fiscal years beginning on or after 1 January 2024

2025

Undertaxed Payment Rule to be implemented for fiscal years beginning on or after 1 January 2025

1.2 OECD Pillar Two – Key Rules

1.2.1 Key OECD Rules

Main Rule:

- Income inclusion rule (IIR)

Back Stop-Rule:

- Undertaxed payments rule (UTPR)

Domestic Rule:

- Qualified Domestic Minimum Top-up Tax (QDMTT)

Tax Treaty Rule:

- Subject to tax rule (STTR)

1.2.2 Implementation timeline

Implemented for FY beginning on or after 1-Jan-2024:

- IIR & QDMTT ~ 28 Jurisdictions

Expected Implementation from FY beginning on or after 1-Jan-25

1.3 Jurisdiction wise Implementation Status

Jurisdictions that have implemented IIR & QDMTT from 2024

- Germany

- Austria

- Belgium

- Canada

- Croatia

- Finland

- Hungary

- Ireland

- Italy

- Luxembourg

- Netherlands

- Slovenia

- Spain

- Australia

- Bulgaria

- Denmark

- France

- Greece

- Korea*

- Norway

- Portugal

- Romania

- Sweden

- UK

- Viet Nam

- Japan#

- Switzerland^

- Poland**

* Korea has not announced implementation of QDMTT

# Japan has announced implementation from 1 April 2024

^ Switzerland has announced only QDMTT from 1 January 2024

** Poland has not announced the implementation date; however, it is bound by the EU directive to implement for fiscal years beginning on or after 31 December 2023

Jurisdictions that have implemented IIR & QDMTT from 2025

- Hong Kong

- Malaysia

- Singapore

- Thailand

Jurisdictions that have deferred implementation by 5 years

- Slovakia

- Malta

Jurisdictions that have not announced implementation of Pillar Two Law

- Argentina

- Armenia

- Bahrain

- Bangladesh

- Bosnia and Herzegovina

- Brazil

- British Virgin Islands

- Cayman Islands

- Chile

- China

- Colombia

- Costa Rica

- Dominican Republic

- Egypt

- India

- Indonesia

- Israel

- Jordan

- Kazakhstan

- Kenya

- Kuwait

- Mauritius

- Mexico

- Morocco

- New Zealand

- Oman

- Pakistan

- Panama

- Peru

- Philippines

- Puerto Rico

- Qatar

- Russia

- Saudi Arabia

- Serbia

- South Africa

- Sri Lanka

- Tunisia

- Turkey

- UAE

- Ukraine

- Uruguay

- USA

Jurisdictions that are not part of inclusive framework

- Algeria

- Czech Republic

- Ecuador

- El Salvador

- Guatemala

- Lesotho

- Taiwan

- Venezuela

2. Overview of the Rules

2.1 OECD Pillar Two – Rule Overview

Qualified Domestic Minimum Top-up Tax (QDMTT)

- Model Law provides an option to each jurisdiction to implement a qualified domestic top-up tax law which should be in line with the Pillar Two Model Law.

- The QDMTT law would enable the jurisdictions to compute the effective tax rate of the entities located in its jurisdiction and collect the top-up taxes itself, instead of ceasing its taxing rights to a parent jurisdiction under the IIR mechanism.

- The Pillar Two Model law provides a credit for Qualified Domestic Minimum Top-up tax which is paid in a low tax jurisdiction.

Income inclusion rule (IIR)

- The charging provisions are made up of two interlocking rules – the IIR and the UTPR.

- The IIR Rule is applied by certain Parent Entities in the MNE Group using an ordering rule that generally gives priority in the application of the rule to the entities closest to the top in the chain of ownership (the “top-down” approach).

Undertaxed payments rule (UTPR)

- UTPR Rule serves as a backstop rule to IIR rule. It is applied by way of denial of a deduction (or an equivalent adjustment) to constituent entities that are low tax constituent entities that is not subject to tax under IIR rule.

2.2 OECD Pillar Two – Computation Flow

- In Scope MNEs

- Transitional Safe Harbour (TSH) Applicability

- Undertake detailed Computation

- GloBE Income, Covered Taxes, ETR (%)

- Determine Top-up Tax Liability

- Set-off with QDMTT taxes paid

- Allocation of top-up taxes under IIR & UTPR Rule

2.3 Safe Harbours

Transitional Safe Harbour

- Transitional Safe Harbour (CBCR Safe Harbours): It provides for 3 tests, i.e., De-minims Test, ETR (%) Test and Routine Profit Test. In case if the entities at jurisdiction level meet any of the three tests, then all such entities located in that jurisdiction would be exempted from undertaking detailed computation.

- Transition Period: The safe harbour is also limited to a transitional period that applies to fiscal years beginning on or before 31/12/2026 but not including a fiscal year that ends after 30/6/2028.

- Transition Rate means: 15% for fiscal years beginning in 2023 and 2024; 16% for fiscal years beginning in 2025; and 17% for fiscal years beginning in 2026.

2.4 ETR & Top-up Tax

Effective Tax Rate (ETR) (for a jurisdiction) = Adjusted Covered Taxes for all Constituent Entities in the jurisdiction (Covered Taxes)/Net GloBE Income for all Constituent Entities in the jurisdiction (GloBE Income)

Top-up taxes would be computed for jurisdictions which have a ETR or less than 15% (i.e., Low Tax Jurisdiction)

Top-up Tax (for a low tax jurisdiction) = Top-up Tax Percentage x Excess Profits + Additional Current Top-up Tax – Domestic Top-up Tax

Top-up Tax Percentage = 15% (minimum rate) – ETR

Excess Profits = Net GloBE Income – Substance-based income exclusion

Additional Current Top-up Tax = Additional top-up tax in respect of a prior period

Domestic Top-up Tax = Amount payable domestically

Substance-based income exclusion of a fixed return on

Payroll: 10% (to be reduced to 5% over 10 years). Includes salaries, health insurance, pension contributions, employment taxes and employer social security contributions. Eligible employees include independent contractors.

*Net Book Value of Tangible assets

Tangible assets: 8% (to be reduced to 5% over 10 years). Includes property, plant and equipment, and natural resources

* Net Book Value of Tangible Assets means the average of the beginning and end values of Tangible Assets after considering accumulated depreciation, depletion, and impairment, as recorded in the financial statements.

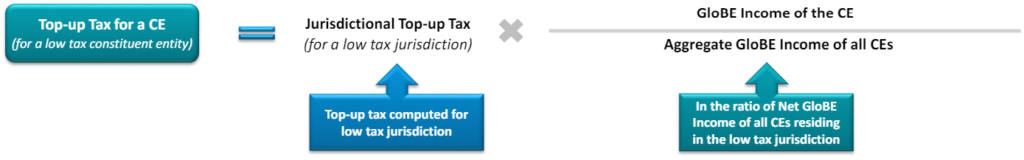

2.5 Allocation of Top-up Tax

The top-up taxes of a low tax jurisdictions are allocated to the entities in that jurisdiction based on the following formula:

The top-up taxes of low tax constituent entity (LTCE) are collected by the below 2 mechanisms:

LTCE Top-up Tax

- IIR Mechanism

- UTPR Mechanism

2.6 GloBE Information Return

A comprehensive set of the data points that an MNE Group may need to collect in order to calculate the MNE Group’s GloBE tax liability.

General Information: Which includes general information about the MNE Group and the Filing Constituent Entity.

Corporate structure: Includes information about the corporate structure of the MNE Group, in particular each Constituent Entity’s ownership structure, whether it is required to apply the IIR and whether the UTPR could apply with respect to such Constituent Entity, as well as information about changes to the ownership structure that took place during the fiscal year.

ETR computation and Top-up Tax computation: Includes information about the Effective Tax Rate and Top-up Tax computations for those jurisdictions where Constituent Entities or members of JV Groups are located, as well as any elections made in accordance with the relevant provisions of the GloBE Rules. This section would also incorporate the simplified compliance procedures associated with any agreed safe harbours.

Top-up Tax allocation and attribution: Includes information on the attribution of Top-up Tax as well as those implementing jurisdictions where such Top-up Tax is payable in accordance with the agreed rule order. It further provides more details on the computation of each Parent Entity’s Allocable Share of Top-up Tax to apply the IIR and on the computation of the UTPR Top-up Tax Amount, if any, as well as of the UTPR Percentage for each UTPR Jurisdiction, where applicable.

The standard deadline for filing GloBE Information Return (GIR) is set at 15 months after the conclusion of the Reporting Fiscal Year. However, for the Transition Year, this deadline is extended to 18 months.

2.7 Accounting Disclosure

Amendments to IAS 12 issued 23 May 2023

- Mandatory exception for deferred tax accounting, announced as a temporary exception

- Disclose if mandatory temporary exception is applied, applicable for interim periods in 2023 and 2024.

- An entity will be required to disclose separately the amount of current tax expense attributable to Pillar II

- Qualitative and quantitative information to help users understand Pillar II exposure

- To the extent information is not known/reasonably estimable, a disclosure should made to that effect

- Information about the progress made in assessing entity’s exposure to Pillar II taxes.

Exposure Draft on IND AS 12 issued 25 August 2023

- The Accounting Standards Board, The Institute of Chartered Accountants of India, has issued an exposure draft “International Tax Reform—Pillar Two Model Rules – Amendments to Ind AS 12”.

- The exposure draft provides the same mandatory exception to deferred tax accounting and provides for a disclosure of current tax expense for the annual periods beginning on or after 31 March 2023 and for all interim period beginning on or after 31 March 2024.

- The exposure draft is yet to be finalized by way of an amendment to IND AS 12.

3. India Impact

3.1 India Impact – Outbound Investment

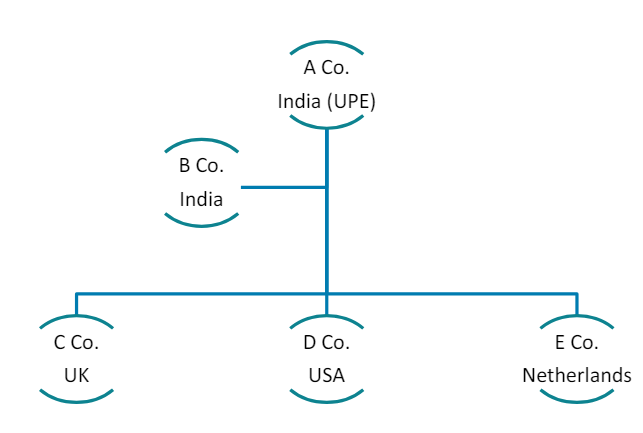

- A Co. and B Co. are located in India. A Co. is the Ultimate Parent Entity of the group. C Co., D Co. and E Co. are located in UK, USA and Netherlands respectively. UK and Netherlands have implemented QDMTT and IIR rules for FY 2024-25. India and USA have not announced implementation of Pillar Two Law.

- Further, no jurisdiction has announced implementation of UTPR Rules.

- In this case, the computation under QDMTT would be undertaken for C Co. in UK and E Co. in Netherlands. Any top-up taxes arising from such computations would be paid in UK and Netherlands. No computation under Pillar Two would be required for B Co. and D Co.

- Further, ETR computation would be triggered for Indian and US entities as the MNE is in scope of Pillar Two law. However, top-up taxes, if any would not be collected by any jurisdiction in absence of IIR rules in India or UTPR rules in any other jurisdiction.

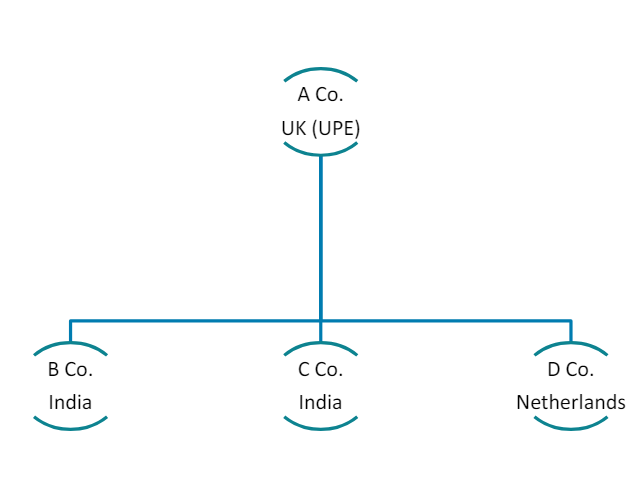

3.2 India Impact – Inbound Investment

3.3 Impact on Indian MNEs

India being a member of the Inclusive Framework, is expected to incorporate the GloBE Rules into its domestic law. In the interim budget, announced on 1st February 2024, there were no policy announcements on the implementation of the GloBE Rules in India. The announcement may take place in the ‘full budget’ to be released later this year.

- Application of Pillar Two to Indian MNEs: Since the GloBE Rules may have come into effect (say, from 1st January 2024) in other jurisdictions where Indian headquartered MNE groups have presence, such MNE groups will be required to comply with the GloBE Rules even if India has not implemented the rules for that period.

- Disclosure: Indian MNE groups will have to provide for top-up tax in the books of account, if applicable, in their financial statements for the year ended 31st March 2025, if India introduces the law.

- Benefit of tax incentives in India would be limited: In-scope MNE groups availing tax incentives such as IFSC unit will need to evaluate the overall tax impact in India, pursuant to the Pillar Two Globe Rules. However, a group having non IFSC presence along with a unit in IFSC, may be able to benefit from the jurisdictional blending at India level.

4. Practical Issues

4.1 Issue 1: Financial Statements to be used for Pillar Two Computations

Brief Background

- Article 3.1 Financial Accounts prescribes that financial statements that are used for preparing the consolidated financial statements of the group (prior to any consolidation adjustments eliminating intra-group transactions) is required to be considered.

- However, if it is not practicable to use the financial statements for consolidation, then another set of financial statements can be used if such financial statements are:

- prepared using the Acceptable Financial Accounting Standard or an Authorised Financial Accounting Standard

- Information is reliable and

- In case there is a permanent difference exceeding Euro 1 million arising on account of use of an accounting standard different from the UPE’s accounting standard, then such difference should be conformed by the UPE’s accounting standard.

- Further, the accounting standard used for preparing consolidated financial statements should also be Acceptable Financial Accounting Standard or an Authorised Financial Accounting Standard.

Key Consideration

- Acceptable Financial Accounting Standard means International Financial Reporting Standards (IFRS) and the generally accepted accounting principles of Australia, Brazil, Canada, Member States of the European Union, Member States of the European Economic Area, Hong Kong (China), Japan, Mexico, New Zealand, the People’s Republic of China, the Republic of India, the Republic of Korea, Russia, Singapore, Switzerland, the United Kingdom, and the United States of America.

- Authorised Financial Accounting Standard, in respect of any Entity, means a set of generally acceptable accounting principles permitted by an Authorised Accounting Body in the jurisdiction where that Entity is located.

4.2 Issue 2: Treatment of opening brought forward tax losses in the Transition Year

Brief Background

- In case an entity has recorded a tax loss during the fiscal year prior to Transition Year, the brought forward tax losses would be eligible to be set-off against the taxable income arising in the Transitional Year or subsequent years, under the local tax law of that jurisdiction. This would result in a low tax liability in future. Hence, the entity would generally recognize a deferred tax asset (“DTA”) in its books which would be reversed in the year in which such losses are utilized.

- Article 9.1 of the Pillar Two law provides for Transition Rules wherein, such opening deferred tax assets recognized on brought forward tax losses is eligible to be considered as part of the computation of adjusted covered taxes in the year in which such tax loss is utilized.

Practical Issue

- However, in certain situations, entities do not recognize a deferred tax asset on brought forward tax losses, due to valuation allowance or accounting adjustments. In such cases, there are no opening deferred tax attributed recorded in the financial statements in the Transition Year.

4.3 Issue 3: Whether PE are required to maintain separate FS

Brief Background

- The Pillar Two Law recognizes a permanent establishment (“PE”) as a separate constituent entity under the computation of Net GloBE Income, Adjusted Covered Taxes and ETR(%). In order to undertake separate computations of a PE, the income and taxes that are attributable to a PE shall be reallocated to it from the Main Entity. The income and taxes attributable to the PE can be identified from the financial statements prepared for the PE.

Practical Issue

- However, in certain situations, separate financial statements are not prepared for a PE. In such case, the MNE group relies on the internal management accounts prepared for the PE to identify the income and taxes attributable to a PE.

Key Consideration

- Whether separate financial statements are required to be prepared for a PE on account of Pillar Two Law.

4.4 Issue 4: Accounting Disclosures

Brief Background

- IAS 12 has passed an amendment which will require entities to provide a disclosure related to the impact of Pillar Two under current taxes and provide a disclosure to mention that mandatory temporary exception has been availed for deferred taxes.

- A similar disclosure requirement is not yet implemented for IND AS 12.

Practical Issue

- In case of Indian HQ MNEs, whether disclosure would be required in the consolidated financial statements, while consolidating an entity that has provided a disclosure under IAS 12.

4.5 Issue 5: BEAT and Similar Taxes

Brief Background

- Article 4.2 of the Pillar Two Law provides that covered taxes include the following:

- Taxes recorded in the financial accounts of a Constituent Entity with respect to its income or profits or its share of the income or profits of a Constituent Entity in which it owns an Ownership Interest;

- Taxes on distributed profits, deemed profit distributions, and non-business expenses imposed under an Eligible Distribution Tax System;

- Taxes imposed in lieu of a generally applicable corporate income tax; and

- Taxes levied by reference to retained earnings and corporate equity, including a Tax on multiple components based on income and equity.

- Entities in the USA are required to pay tax which is meant to prevent foreign and domestic corporations operating in the United States from avoiding domestic tax liability by shifting profits out of the United States called BEAT Taxes. Such taxes are imposed in addition to the normal corporate tax in the USA.

Practical Issue

- Whether BEAT Tax can be considered as covered taxes under Pillar Two Law.

4.6 Other Issues

- Impact on IFSC

- Transfer pricing Adjustments

- Implication on M&A activity

- Tax Exemption/Benefit regimes will have limited relevance

- Impact on payments to associated enterprises (STTR Rule)

- Errors in CBCR/Financial Statements

- Impact on Qualified Refundable Tax Credits (QRTCs)

- Additional Compliance Burden (GIR + QDMTT)

- CBCR Safe Harbour have little to do with CBCR

5. Way Forward and Futuristic Outlook

5.1 Data Extraction

Define process for:

- Identify Data and its Source

- Automate extraction into template or system

5.2 Technology/Solution

Align process and tool: Evaluate AS/IS vs. need for Pillar Two solutions. Consider current CIT setup and alignment to Pillar Two

QDMTT – filings

- Outsourcing

- Own filings

5.3 Monitor Legislation

Adjust for change in:

OECD new Guidance

- Permanent Safe Harbour

- IIR and UTPR

- Local QDMTT (CE or Jurisdictional level)

5.4 Transitional Safe Harbour

Set process for:

- Safe Harbour Calculation

- Qualified CbCR

- Monitor Safe Harbour

5.5 ETR Computation

Set process and SOP/principles for:

- ETR calculation for low tax entities (short term)

Tax provision:

- Jurisdictional ETR and allocation of taxes

5.6 Compliance & Disclosures

Run/manage operations:

- Global filing

- Local filing for QDMTT

- Accounting Disclosures

The post Pillar Two – Global Anti-base Erosion Rules (GloBE Rules) – Overview | India Impact | Practical Issues appeared first on Taxmann Blog.