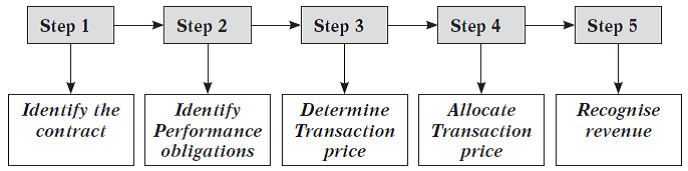

Ind AS 115, Revenue from Contracts with Customers, is an Indian Accounting Standard that provides a comprehensive framework for recognizing revenue. It requires entities to follow a five-step process: identifying the contract with a customer, identifying the performance obligations, determining the transaction price, allocating the transaction price to the performance obligations, and recognizing revenue when (or as) the entity satisfies a performance obligation. The standard aims to ensure that revenue is recognized in a manner that accurately reflects the transfer of goods or services to customers, improving consistency and comparability in financial reporting across industries.

Check out Taxmann's Illustrated Guide to Indian Accounting Standards (Ind AS) which presents a thorough commentary on Indian Accounting Standards (Ind AS) and an analysis of the amended Schedule III of the Companies Act 2013. It addresses Ind AS implementation in India, highlighting its convergence with IFRS. It features numerous diagrams, visual aids, case studies, and practical examples. This book will be helpful for accounting professionals and students, providing extensive definitions, comparative analysis, etc.

Table of Contents

1. Objective

The objective of this Standard is to establish the principles that an entity shall apply to report useful information to users of financial statements about the nature, amount, timing and uncertainty of revenue and cash flows arising from a contract with a customer.

2. Meeting the Objective

To meet the objective in above paragraph, the core principle of this Standard is that an entity shall recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services.

An entity shall consider the terms of the contract and all relevant facts and circumstances when applying this Standard. An entity shall apply this Standard, including the use of any practical expedients, consistently to contracts with similar characteristics and in similar circumstances.

This Standard specifies the accounting for an individual contract with a customer. However, as a practical expedient, an entity may apply this Standard to a portfolio of contracts (or performance obligations) with similar characteristics if the entity reasonably expects that the effects on the financial statements of applying this Standard to the portfolio would not differ materially from applying this Standard to the individual contracts (or performance obligations) within that portfolio. When accounting for a portfolio, an entity shall use estimates and assumptions that reflect the size and composition of the portfolio.

3. Scope

An entity shall apply this Standard to all contracts with customers, except the following:

- Lease contracts within the scope of Ind AS 116, Leases;

- Insurance contracts within the scope of Ind AS 104, Insurance Contracts;

- Financial instruments and other contractual rights or obligations within the scope of Ind AS 109, Financial Instruments, Ind AS 110, Consolidated Financial Statements, Ind AS 111, Joint Arrangements, Ind AS 27, Separate Financial Statements and Ind AS 28, Investments in Associates and Joint Ventures; and

- Non-monetary exchanges between entities in the same line of business to facilitate sales to customers or potential customers. For example, this Standard would not apply to a contract between two oil companies that agree to an exchange of oil to fulfil demand from their customers in different specified locations on a timely basis.

An entity shall apply this Standard to a contract (other than a contract listed above) only if the counterparty to the contract is a customer. A customer is a party that has contracted with an entity to obtain goods or services that are an output of the entity’s ordinary activities in exchange for consideration. A counterparty to the contract would not be a customer if, for example, the counterparty has contracted with the entity to participate in an activity or process in which the parties to the contract share in the risks and benefits that result from the activity or process (such as developing an asset in a collaboration arrangement) rather than to obtain the output of the entity’s ordinary activities.

A contract with a customer may be partially within the scope of this Standard and partially within the scope of other Standards. The following situations may arise:

- If the other Standards specify how to separate and/or initially measure one or more parts of the contract, then an entity shall first apply the separation and/or measurement requirements in those Standards. An entity shall exclude from the transaction price the amount of the part (or parts) of the contract that are initially measured in accordance with other Standards and shall apply the guidance related to allocating the amount of the transaction price that remains (if any) to each performance obligation within the scope of this Standard and to any other parts of the contract identified by next paragraph.

- If the other Standards do not specify how to separate and/or initially measure one or more parts of the contract, then the entity shall apply this Standard to separate and/or initially measure the part (or parts) of the contract.

This Standard specifies the accounting for the incremental costs of obtaining a contract with a customer and for the costs incurred to fulfil a contract with a customer if those costs are not within the scope of another Standard. An entity shall apply those paragraphs only to the costs incurred that relate to a contract with a customer (or part of that contract) that is within the scope of this Standard.

4. Recognition

The Ind AS 115 has come up with a five step model for recognizing revenue from contracts with customers. This is diagrammatically represented as under:

These steps are explained in the paragraphs that follow.

4.1 Identifying the contract

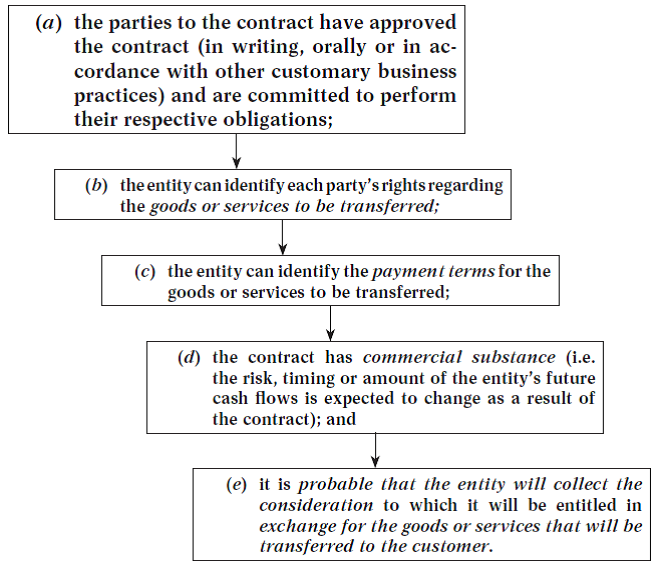

An entity shall account for a contract with a customer that is within the scope of this Standard only when all of the following criteria are met:

- The parties to the contract have approved the contract (in writing, orally or in accordance with other customary business practices) and are committed to perform their respective obligations;

- The entity can identify each party’s rights regarding the goods or services to be transferred;

- The entity can identify the payment terms for the goods or services to be transferred;

- The contract has commercial substance (i.e. the risk, timing or amount of the entity’s future cash flows is expected to change as a result of the contract); and

- It is probable that the entity will collect the consideration to which it will be entitled in exchange for the goods or services that will be transferred to the customer. In evaluating whether collectability of an amount of consideration is probable, an entity shall consider only the customer’s ability and intention to pay that amount of consideration when it is due. The amount of consideration to which the entity will be entitled may be less than the price stated in the contract if the consideration is variable because the entity may offer the customer a price concession.

Hence, an entity shall account for a contract with a customer that is within the scope of this Ind AS only when all of the following criteria are met:

A contract is an agreement between two or more parties that creates enforceable rights and obligations. Enforceability of the rights and obligations in a contract is a matter of law. Contracts can be written, oral or implied by an entity’s customary business practices. The practices and processes for establishing contracts with customers vary across legal jurisdictions, industries and entities. In addition, they may vary within an entity (for example, they may depend on the class of customers or the nature of the promised goods or services). An entity shall consider those practices and processes in determining whether and when an agreement with a customer creates enforceable rights and obligations.

Illustration 1: Product delivered without written contract

Seller’s practice is to obtain written and customer-signed sales agreements. Seller delivers a product to a customer without a signed agreement based on a request by the customer to fill an urgent need.

Can an enforceable contract exist if Seller has not obtained a signed agreement consistent with its customary business practice?

Analysis

It depends. Seller needs to determine if a legally enforceable contract exists without a signed agreement. The fact that it normally obtains written agreements does not necessarily mean an oral agreement is not a contract; however, Seller must determine whether the oral arrangement meets all of the criteria to be a contract.

Some contracts with customers may have no fixed duration and can be terminated or modified by either party at any time. Other contracts may automatically renew on a periodic basis that is specified in the contract. An entity shall apply this Standard to the duration of the contract (i.e. the contractual period) in which the parties to the contract have present enforceable rights and obligations.

For the purpose of applying this Standard, a contract does not exist if each party to the contract has the unilateral enforceable right to terminate a wholly unperformed contract without compensating the other party (or parties). A contract is wholly unperformed if both of the following criteria are met:

- The entity has not yet transferred any promised goods or services to the customer; and

- The entity has not yet received, and is not yet entitled to receive, any consideration in exchange for promised goods or services.

If a contract with a customer meets the criteria for identifying a contract at contract inception, an entity shall not reassess those criteria unless there is an indication of a significant change in facts and circumstances. For example, if a customer’s ability to pay the consideration deteriorates significantly, an entity would reassess whether it is probable that the entity will collect the consideration to which the entity will be entitled in exchange for the remaining goods or services that will be transferred to the customer.

If a contract with a customer does not meet the criteria, an entity shall continue to assess the contract to determine whether the criteria for identifying a contract are subsequently met.

When a contract with a customer does not meet the criteria and an entity receives consideration from the customer, the entity shall recognize the consideration received as revenue only when either of the following events has occurred:

- the entity has no remaining obligations to transfer goods or services to the customer and all, or substantially all, of the consideration promised by the customer has been received by the entity and is non-refundable; or

- The contract has been terminated and the consideration received from the customer is non-refundable.

Depending on the facts and circumstances relating to the contract, the liability recognized represents the entity’s obligation to either transfer goods or services in the future or refund the consideration received. In either case, the liability shall be measured at the amount of consideration received from the customer.

4.1.1 Combination of contracts

An entity shall combine two or more contracts entered into at or near the same time with the same customer (or related parties of the customer) and account for the contracts as a single contract if one or more of the following criteria are met:

- The contracts are negotiated as a package with a single commercial objective;

- The amount of consideration to be paid in one contract depends on the price or performance of the other contract; or

- The goods or services promised in the contracts (or some goods or services promised in each of the contracts) are a single performance obligation.

Illustration 2

| There are three different contracts, one for the construction of a stadium, fencing around the stadium and creating arterial roads around the stadium. The contracts were negotiated as a single package. The stadium contract has 25% margin, the fencing 10% margin and the arterial roads 5% and the three contracts together had a margin of 15%. The contracts are to be performed in sequence. |

| Solution The three contracts highlighted above will be combined into one contract for the purpose of applying the standard. |

4.1.2 Contract modifications

A contract modification is a change in the scope or price (or both) of a contract that is approved by the parties to the contract. In some industries and jurisdictions, a contract modification may be described as a change order, a variation or an amendment. A contract modification exists when the parties to a contract approve a modification that either creates new or changes existing enforceable rights and obligations of the parties to the contract. A contract modification could be approved in writing, by oral agreement or implied by customary business practices. If the parties to the contract have not approved a contract modification, an entity shall continue to apply this Standard to the existing contract until the contract modification is approved.

A contract modification may exist even though the parties to the contract have a dispute about the scope or price (or both) of the modification or the parties have approved a change in the scope of the contract but have not yet determined the corresponding change in price. In determining whether the rights and obligations that are created or changed by a modification are enforceable, an entity shall consider all relevant facts and circumstances including the terms of the contract and other evidence. If the parties to a contract have approved a change in the scope of the contract but have not yet determined the corresponding change in price, an entity shall estimate the change to the transaction price arising from the modification in accordance with guidance on estimating variable consideration and on constraining estimates of variable consideration in subsequent paragraphs.

An entity shall account for a contract modification as a separate contract if both of the following conditions are present:

- The scope of the contract increases because of the addition of promised goods or services that are distinct; and

- The price of the contract increases by an amount of consideration that reflects the entity’s standalone selling prices of the additional promised goods or services and any appropriate adjustments to that price to reflect the circumstances of the particular contract. For example, an entity may adjust the stand-alone selling price of an additional good or service for a discount that the customer receives, because it is not necessary for the entity to incur the selling-related costs that it would incur when selling a similar good or service to a new customer.

Illustration 3

| Acme Construction Co. has been awarded a contract for the construction of a large warehouse at ` 2 million. The customer added to the original scope of work a generator room and a compound wall and authorised ` 0.4 million. The cost of building material increased by a large margin compared to the estimated cost when the contract was signed, the contractor claimed ` 0.5 million separately on this count. It was agreed by the customer that if the contract is completed within one year, then the contractor would be awarded an incentive of ` 0.2 million. The original contract was awarded to Acme Construction Co. on 1st April 2020 and the contractor completed the contract by 28th February 2021. Please calculate the contract revenue based on contract modification. Solution Original contract value = ` 2.0 million. Variation = ` 0.4 million. – additional cost of generator room and compound wall Claim = ` 0.5 million – increased cost of building material claimed by contractor Incentives = ` 0.2 million – As the contract was completed within one year Total contact revenue = ` 3.1 million (2.0 + 0.4+0.5+0.2) based on contract modification |

If a contract modification is not accounted for as a separate contract, an entity shall account for the promised goods or services not yet transferred at the date of the contract modification (i.e. the remaining promised goods or services) in whichever of the following ways is applicable:

(a) An entity shall account for the contract modification as if it were a termination of the existing contract and the creation of a new contract, if the remaining goods or services are distinct from the goods or services transferred on or before the date of the contract modification. The amount of consideration to be allocated to the remaining performance obligations (or to the remaining distinct goods or services in a single performance obligation is the sum of:

(i) The consideration promised by the customer (including amounts already received from the customer) that was included in the estimate of the transaction price and that had not been recognized as revenue; and

(ii) The consideration promised as part of the contract modification.

(b) An entity shall account for the contract modification as if it were a part of the existing contract if the remaining goods or services are not distinct and, therefore, form part of a single performance obligation that is partially satisfied at the date of the contract modification. The effect that the contract modification has on the transaction price, and on the entity’s measure of progress towards complete satisfaction of the performance obligation, is recognized as an adjustment to revenue (either as an increase in or a reduction of revenue) at the date of the contract modification (i.e. the adjustment to revenue is made on a cumulative catch-up basis).

(c) If the remaining goods or services are a combination of items (a) and (b), then the entity shall account for the effects of the modification on the unsatisfied (including partially unsatisfied) performance obligations in the modified contract in a manner that is consistent with the objectives of this paragraph.

Illustration 4: Extension of contract

| SP Co. has a 12-month agreement to provide Customer with services for which Customer pays ` 1,000 per month. The agreement does not include any provisions for automatic extensions, and it expires on November 30, 20X6. The two parties sign a new agreement on February 28, 20X7, which requires Customer to pay ` 1,250 per month in fees, retrospective to December 1, 20X6. Customer continued to pay ` 1,000 per month during December, January, and February, and SP Co. continued to provide services during that period. There are no performance issues being disputed between the parties in the expired period, only negotiation of rates under the new contract. Does a contract exist in December, January, and February (prior to the new agreement being signed)? Analysis A contract appears to exist in this situation because SP Co. continued to provide services and Customer continued to pay ` 1,000 per month according to the previous contract. However, since the original arrangement expired and did not include any provision for automatic extension, determining whether a contract exists during the intervening period from December to February requires judgment and analysis of the legal enforceability of the arrangement in the relevant jurisdiction. Revenue recognition should not be deferred until the written contract is signed if there are enforceable rights and obligations established prior to the conclusion of the negotiations. |

4.2 Identifying performance obligations

At contract inception, an entity shall assess the goods or services promised in a contract with a customer and shall identify as a performance obligation each promise to transfer to the customer either:

| (a) a good or service (or a bundle of goods or services) that is distinct; or (b) a series of distinct goods or services that are substantially the same and that have the same pattern of transfer to the customer. |

4.2.1 Promises in contracts with customers

A contract with a customer generally explicitly states the goods or services that an entity promises to transfer to a customer. However, the performance obligations identified in a contract with a customer may not be limited to the goods or services that are explicitly stated in that contract. This is because a contract with a customer may also include promises that are implied by an entity’s customary business practices, published policies or specific statements if, at the time of entering into the contract, those promises create a valid expectation of the customer that the entity will transfer a goods or service to the customer.

Performance obligations do not include activities that an entity must undertake to fulfil a contract unless those activities transfer a good or service to a customer. For example, a services provider may need to perform various administrative tasks to set up a contract. The performance of those tasks does not transfer a service to the customer as the tasks are performed. Therefore, those setup activities are not a performance obligation.

4.2.2 Distinct goods or services

Depending on the contract, promised goods or services may include, but are not limited to, the following:

- Sale of goods produced by an entity (for example, inventory of a manufacturer);

- Resale of goods purchased by an entity (for example, merchandise of a retailer);

- Resale of rights to goods or services purchased by an entity (for example, a ticket resold by an entity acting as a principal);

- Performing a contractually agreed-upon task (or tasks) for a customer;

- Providing a service of standing ready to provide goods or services (for example, unspecified updates to software that are provided on a when-and-if-available basis) or of making goods or services available for a customer to use as and when the customer decides;

- Providing a service of arranging for another party to transfer goods or services to a customer (for example, acting as an agent of another party);

- Granting rights to goods or services to be provided in the future that a customer can resell or provide to its customer (for example, an entity selling a product to a retailer promises to transfer an additional goods or service to an individual who purchases the product from the retailer);

- Constructing, manufacturing or developing an asset on behalf of a customer;

- Granting licences; and

- Granting options to purchase additional goods or services (when those options provide a customer with a material right).

A goods or service that is promised to a customer is distinct if both of the following criteria are met:

- The customer can benefit from the goods or service either on its own or together with other resources that are readily available to the customer (i.e. the good or service is capable of being distinct); and

- The entity’s promise to transfer the goods or service to the customer is separately identifiable from other promises in the contract (i.e. the promise to transfer the goods or service is distinct within the context of the contract).

Illustration 5: Identifying performance obligations

| ABC Software Co. sold a software license to one of its clients. The contract with the client states that ABC is to provide software updates and technical support for the next 3 years from the date of sale. The software remains functional without updates and technical support. In this case ABC needs to identify distinct performance obligations in order to recognise revenue. The software is delivered to the client before providing updates and technical support and also the customer can benefit from the software distinctly on its own. Also the other parts of the contract requiring technical support and updates are separately identifiable. On the basis of this evaluation, ABC concludes three performance obligations which are:

|

The post Revenue Recognition and Contracts with Customers under Ind AS 115 – Objective | Scope | Recognition appeared first on Taxmann Blog.